At ATC we have been offering a number of high-quality services to HNWI clients as well as players in the investment landscape.

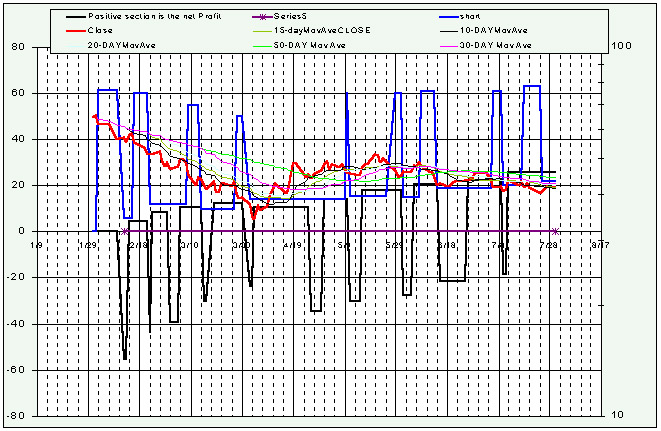

Also, we have developed an investment algorithm for the financial market that is very effective and competes favorably with products by prominent investment banking firms. For more detailed information please visit "Advanced Technical Analysis of Market".

What is Private Banking?

Private Banking refers to the type of premium-level banking that a bank may offer to high net-worth individuals, a term that refers to wealthy individuals.

The term Private Banking is sometimes used interchangeably with another term, ‘wealth management’, although this usage often depends on geographical location.

Unlike the high volume, commoditized retail banking services, private banking would normally personalize services by tailoring them specifically for an individual client.

Most often, private banking implies a relationship between the client and a named ‘personal’ banker who will deal with all of the client’s banking needs. In some cases the relationship may also extend to the client’s extended family. A 24 hour service may be available. Other related services are offered such as creating trusts, offering tax and investment advice and providing portfolio management or other asset management facilities.

Private banking is normally offered by banks to qualified customers as a fee-based service.

The computer systems that cater to this type of banking will reflect the range and level of the services that the bank is offering. Typically they will allow a bank to offer great flexibility in establishing banking products and account options. The range of services and flexibility of reporting will also be generally superior to those offered by the purely core banking systems or the retail banking systems.

In the smaller private banks, all of the services may be offered through a single computer system whereas in the private banking operations of larger international banking groups specialist systems from the investment banking and asset management arms may be combined to offer an integrated service. There is a heavy reliance by private banks on automated portfolio management systems that will assist account managers or investment managers service and administer their customers’ investment portfolios.

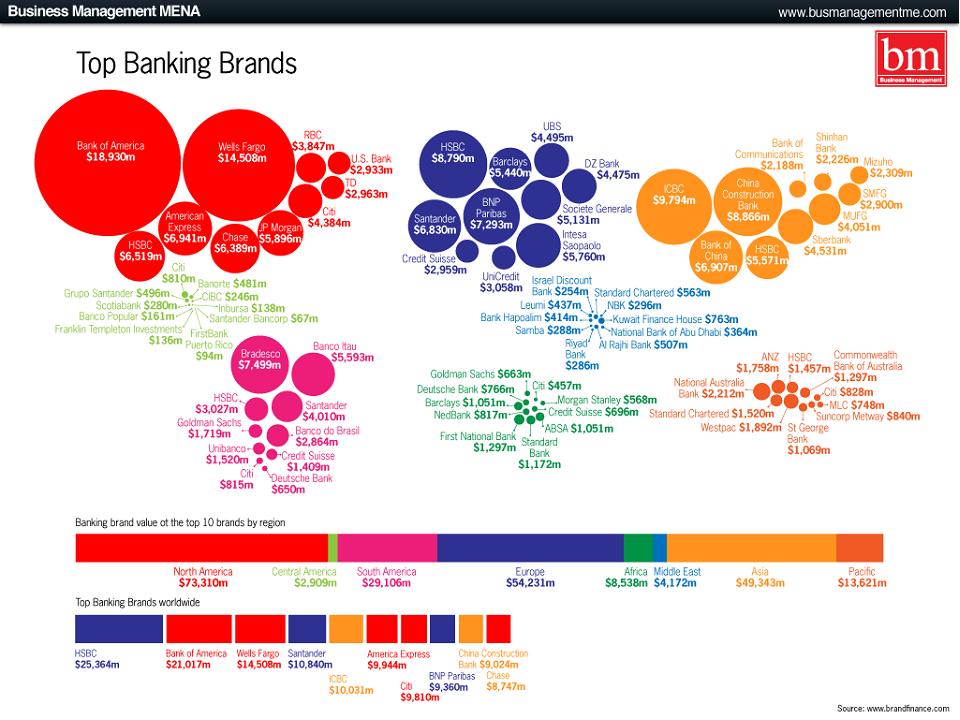

Traditionally some of the western European countries were seen as being the center of the private banking world, particularly Switzerland and Luxembourg. Some ‘off-shore’ centers such as Jersey, Guernsey and Bermuda became popular, particularly with UK residents, during years of high taxation in the 1960s-1970s. One of the most significant trends in the industry recently has been the move from ‘off-shore’ to ‘on-shore’ so today, private banking can be found in almost every country particularly Hong Kong, the Middle East and the developed nations